Award-winning PDF software

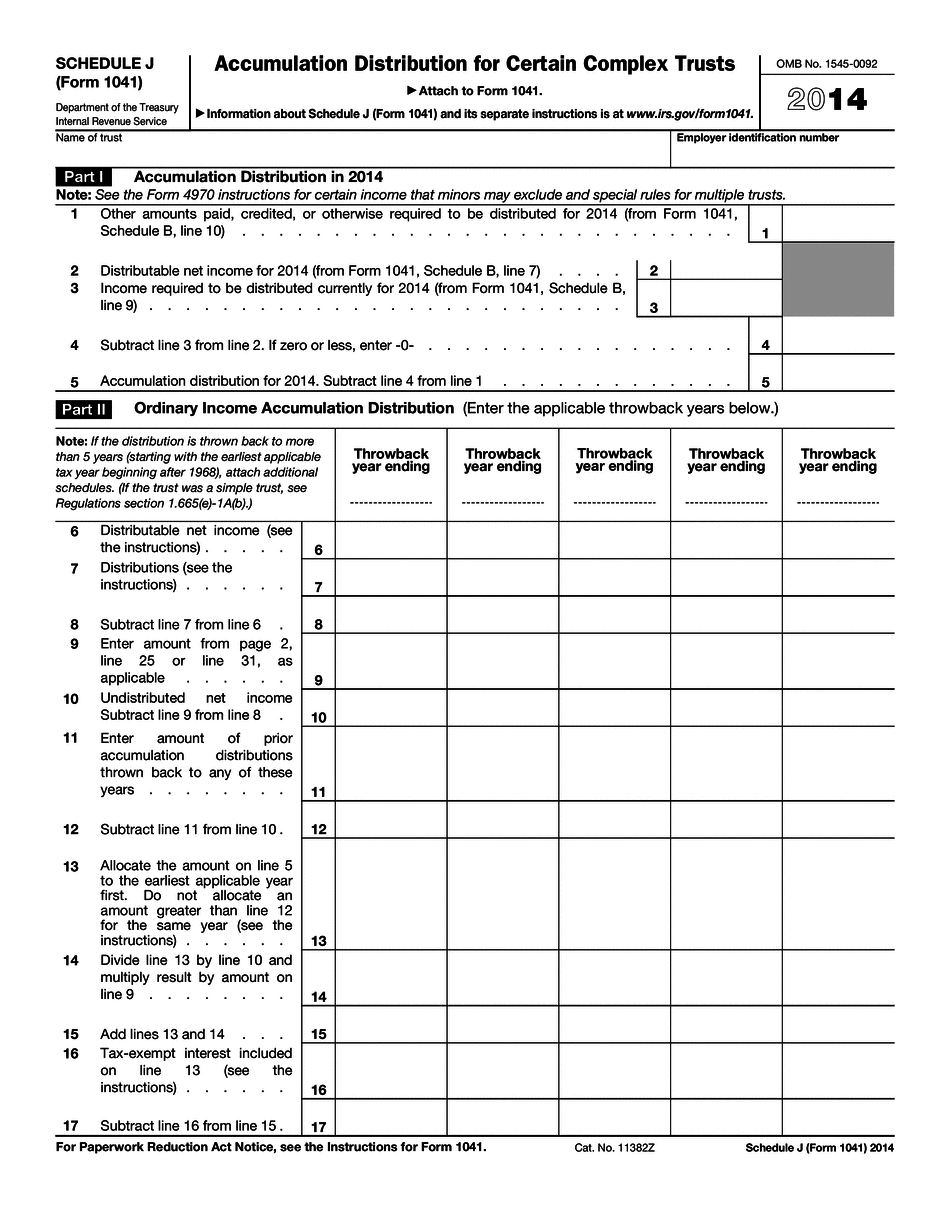

Schedule J (1041 form) 2024 for Carlsbad California: What You Should Know

A trust is an established relationship between related persons which provides protection for certain rights (beneficiary's rights) that the beneficiary (trust beneficiary) or the beneficiaries may have over the property of the trust. [1] It generally includes a trust if it holds property that would be subject to a trust tax unless the trust has been approved and is filing a declaration of trust. A trust is owned by anyone or, in some cases, by no one. Under a trust, a person (the settler) has the legal right to direct certain property (e.g., property acquired or developed by the person) to a person, the beneficiary, who receives property from the trust; in return, the person is entitled to return some of that property, or part of it, to the person (the settler). Trusts may also be administered as personal representatives. Under the laws of many states, such as California and New York, no personal representative or personal trustee (as a general rule) exists for a trust. In such cases, there is an executor or administrator (a personal representative or personal trustee). The executor is the person who serves as executor or administrator on behalf of the estate. The executor, or administrator, is often appointed by the court to take care of a decedent's estate, and who is responsible for administering the estate and paying any personal liabilities such as trust or fiduciary obligations. Under most states, the executor is a person appointed by the court for that purpose and must be approved and licensed by a state in order to serve as executor of an estate. The executor typically is paid a fee to act as executor for the estate. Under the laws of many states, the executor (or administrator) is generally responsible for paying or paying for the distribution from the trust. Generally, this means paying personal liability and paying income taxes on the trust distribution. Trust distributions generally can be distributed in one of six ways: 1. The trust may distribute the trust assets or property in payment of tax liability. 2. The trust may distribute a trust asset (e.g., tax-exempt interest, stock, or real estate) to an individual or entity. 3.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Schedule J (1041 form) 2024 for Carlsbad California, keep away from glitches and furnish it inside a timely method:

How to complete a Schedule J (1041 form) 2024 for Carlsbad California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Schedule J (1041 form) 2024 for Carlsbad California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Schedule J (1041 form) 2024 for Carlsbad California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.