Award-winning PDF software

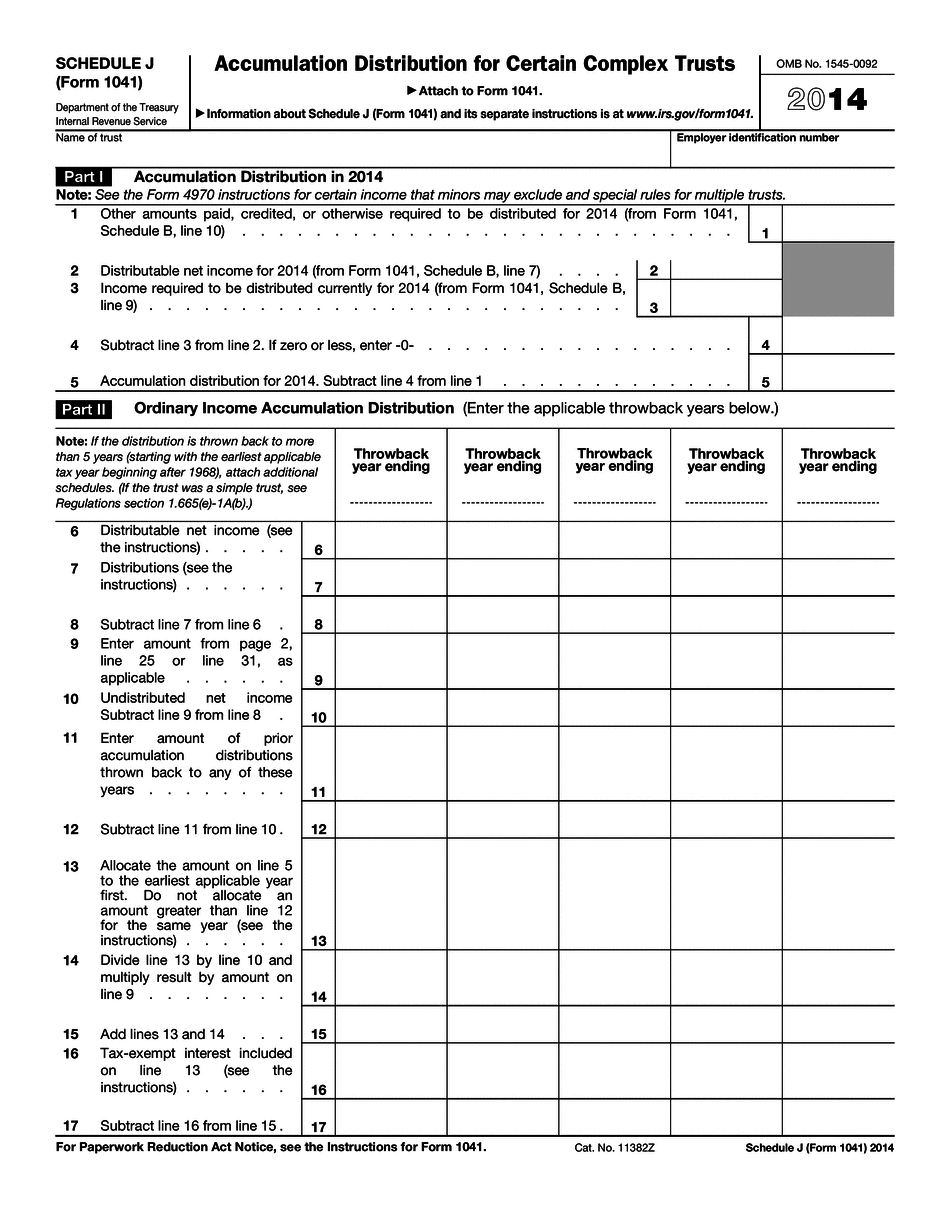

Schedule J (1041 form) 2024 online Arvada Colorado: What You Should Know

ARVADA | CO Sales Tax Rate 2-10% (incl. VAT) Sales Tax — City of Arvada Mar 30, 2024 — Colorado Sales and Use Tax Rates for the Year of Sale Colorado State Sales Tax is 10% of the gross receipts of all taxable transactions for items sold in this state. Colorado State Use tax is 7 cents per pound of vegetables or fruit; 2 cents per gallon of gasoline; 3 cents per gallon of milk; 1 cent per gallon of wine; 3 cents per pound of meat for the purpose of determining sales; 4 cents per pound in any form of tobacco or chewing tobacco; 4 cents per gallon of wine for the purpose of determining wine and beverage purchases when consumed on the premises of the purchaser; 5 cents per gallon of distillate fuel oil; 4 cents per gallon of motor gas oil; 4 cents per gallon of liquefied petroleum gas; and 2 cent per gallon of other refined petroleum gas except petroleum gas. These rates may change periodically by legislative action. Taxation of Sales of Wine & Liquor in Colorado Taxes on Beer & Wine Sales in Colorado are collected by Colorado Beer and Wine Wholesalers, Inc. or Colorado Liquor and Wine Wholesalers Association. If you purchase beer in Colorado you will pay a 5% sales tax. The rest of the sales tax collected goes to pay the expenses of providing the services needed to provide the wine and beer products sold in Colorado. Sales Tax on Alcohol Beverages in Colorado taxes alcohol beverages (alcohol, wine, spirits, etc.) sold at retail at state and local wholesalers with an excise tax (tied to the price of the product) of one-half of the rate of tax specified in the state statute at the point of sale. The excise tax varies by retail location and is set at one half of the federal rate. The federal sales tax on beer, wine and liquor is 19.4% of the retail price, or 2.20 per ounce. Retailers can offset part of the state sales tax on sales on food. The Colorado Department of Revenue has more information about food and beverage sales taxes in Colorado. Colorado has three tax brackets that apply when determining the amount of tax that will apply to each transaction, depending on whether it is for food or for alcohol: Sales Tax Rates For Food (Food for resale) Rate Base Retail Tax on all sales (from food for resale) 7.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Schedule J (1041 form) 2024 online Arvada Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Schedule J (1041 form) 2024 online Arvada Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Schedule J (1041 form) 2024 online Arvada Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Schedule J (1041 form) 2024 online Arvada Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.