Award-winning PDF software

Schedule J (1041 form) 2024 for Palm Beach Florida: What You Should Know

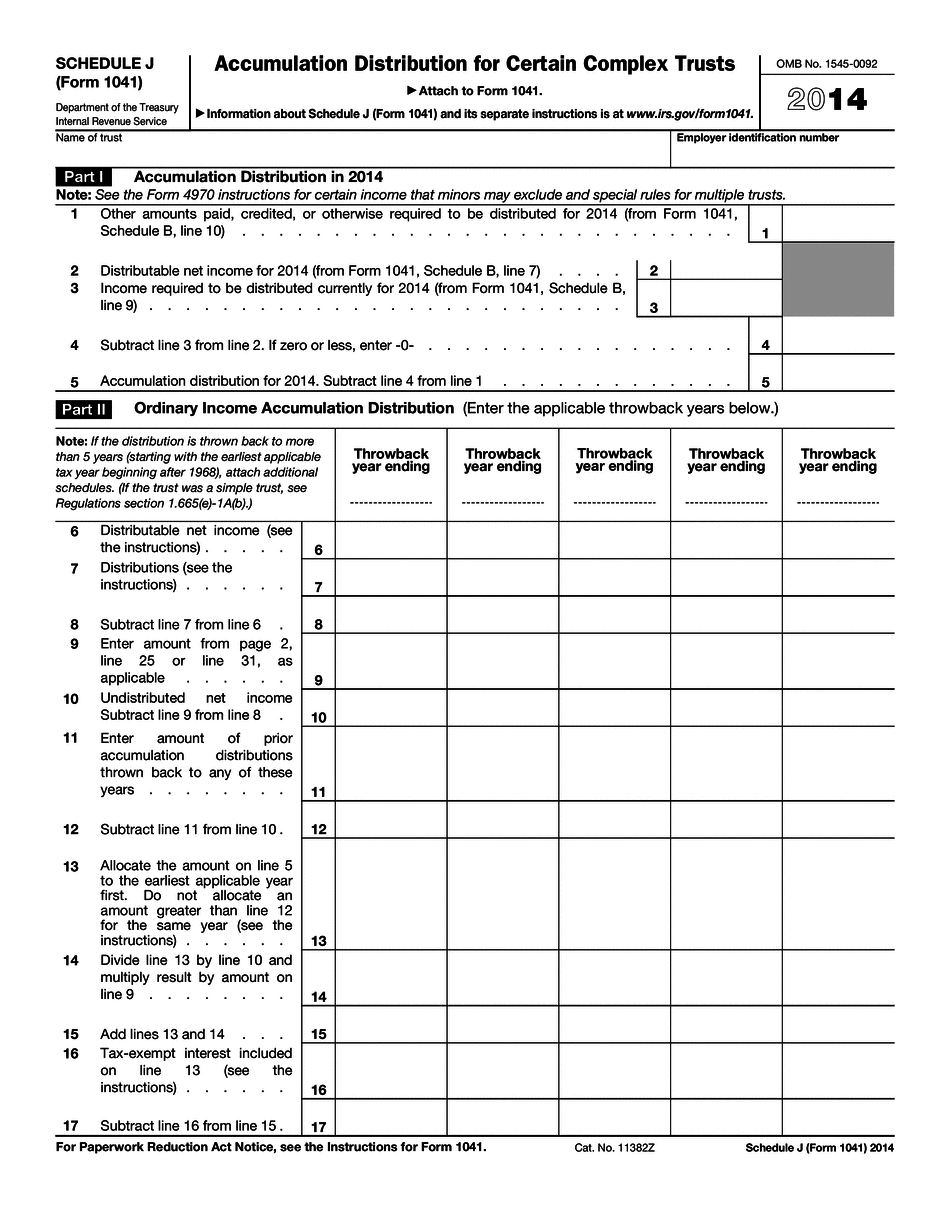

Form 1041, Schedule A. The first tip is that you should check with a competent CPA to determine if the trust is a separate taxpayer under section 408A of the tax code and if the trust's income should be included in the recipient's taxable income based on these same guidelines as those of the owner's taxable income for the year. This is especially useful for estates in the process of preparing their tax returns and in the planning stages of selling their assets. In the past, some CPA firms have advised that trusts and estates with assets below 5,000 should not file their income tax return without first making sure they are aware of their tax liability based on these guidelines. This advice stems from the fact that any taxable income for which an owner has income tax withholding should be reduced by the value of the exempt property that was included as income in the trust. These same guidelines should be applied to the total assets of the distribution so that they do not exceed the value of the recipient's taxable income. If this limit is exceeded, then the excess amount will be subject to the same taxes as if the owner was a taxable individual. An additional warning about determining which trusts to use is that the IRS provides the trustee with the names of all the trusts that were made when an estate is created to determine the income or losses of the trust as a tax beneficiary. This list can be used to prevent the trust from being able to take tax shelter positions and increase the amount of tax required to be paid to the Federal government. This list provides important information to the trustee that should help him or her to ensure that the trust does not participate in these tax shelter maneuvers. The second rule is that only certain types of distribution are subject to the trust or estate taxes. For any trust or estate that must file to any extent, the trust or estate must meet these requirements, as set forth on pages 7 to 9, on the Form 1041: 1) The trust must be a “qualified trust.” An “effective date,” as the term is defined under the Internal Revenue Code, is the date the trust was created or changed from a qualified trust to a qualified trust. The beneficiary's basis in the property must be the same as was the beneficiary's basis in the property on the day before the filing date.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Schedule J (1041 form) 2024 for Palm Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Schedule J (1041 form) 2024 for Palm Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Schedule J (1041 form) 2024 for Palm Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Schedule J (1041 form) 2024 for Palm Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.