Award-winning PDF software

Schedule J (1041 form) 2024 online Bexar Texas: What You Should Know

These are quality work products that measure and evaluate how property values are performing and are used to improve the tax assessment process (especially property tax assessments) in the County. There is a link to our complete Assessment Reports. If your assessor is not using a Performance Quality Assessment you can always send him or her a Performance Quality Assessment. Bexar County Tax Assessor-Collector, Albert Rest We have a link to how to submit a property assessment for the City of Bexar. Our online website allows you to submit online, or you can download our online Form 1555 (Assessment/Tax Declaration). If your city has changed the form, you can update your assessment by downloading and updating the assessment form to the City of Bexar. City of Bexar, City Clerk and Tax Assessor-Collector (Assessor) Elias Santiago Bexar County Tax Assessors-Collector, Paul Kline Our Tax Assessment Process is simple, fair and efficient. The County Tax Assessor-Collector works with our homeowners and commercial property owners. That is why we can provide you services such as: a quick response to questions submitted by residents, a responsive and professional staff, timely and accurate tax assessments, and a variety of services to make property sales tax compliance efficient. Bexar County Tax Assessor-Collector, Albert Rest Our office will send a receipt or statement of assessment once we've completed each assessment, and it has been filed on the assessor's file in the county of record. That process is called an “Assessment Certificate” and is the property tax certificate that reflects, in detail the value of the home sold. City of Bexar, Paul Kline Bexar County Tax Assessors-Collector, Paul Kline Bexar County Taxes — Annual Report for all Tax Assessed Property in the County of Bexar County Assessors-collector is responsible for assessing and collecting the County Sales Tax. If you want Bexar County to collect sales tax on your property, you must contact the proper city and county of Bexar for approval and information regarding your property. This section contains information on how to send the proper tax notices to avoid paying Bexar County sales tax on your property.

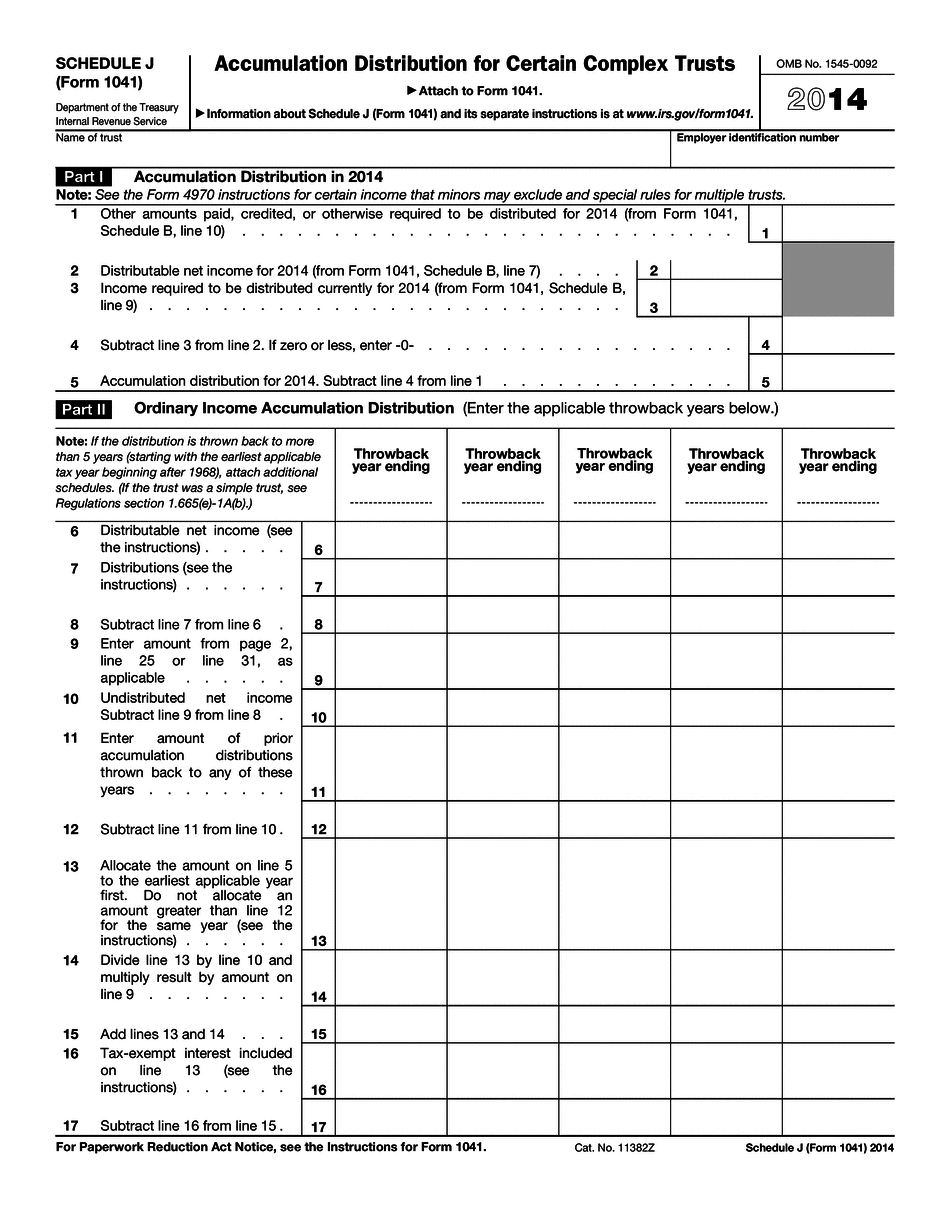

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Schedule J (1041 form) 2024 online Bexar Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Schedule J (1041 form) 2024 online Bexar Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Schedule J (1041 form) 2024 online Bexar Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Schedule J (1041 form) 2024 online Bexar Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.